Let’s be honest. The economic weather changes, and it changes fast. One minute you’re in a sunny expansion, the next you can feel the chill of a slowdown coming on. For investors, it’s not just about holding on through the storm—it’s about knowing which parts of the market are built for the rain, and which are poised to shine when the clouds break.

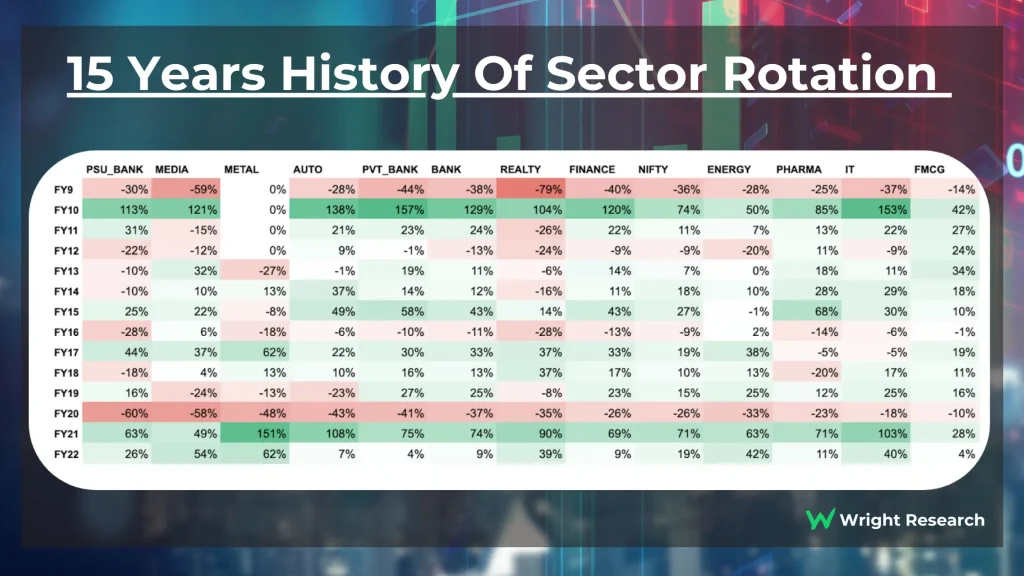

That’s where sector rotation comes in. It’s the strategy of shifting your portfolio’s weight towards different sectors of the economy based on where we are in the business cycle. Think of it less as market timing and more as… economic seasonality. You wouldn’t wear a winter coat in July, right? The same logic applies here.

The Economic Cycle’s Four Seasons

To get sector rotation, you need a handle on the basic phases. The classic model breaks it down into four stages, each with its own character and, crucially, its own leading sectors.

| Cycle Phase | Economic Feel | Typical Sector Leaders |

| Early Cycle | Recovery from recession. Rates low, activity picking up. | Technology, Consumer Discretionary, Industrials |

| Mid-Cycle | Steady growth. Confidence is high. | Technology, Industrials, Basic Materials |

| Late Cycle | Peak growth, rising inflation & rates. | Energy, Materials, Staples |

| Recession | Contraction. Falling demand and profits. | Utilities, Consumer Staples, Healthcare |

Now, these phases don’t have a calendar. They’re fuzzy, they can stretch or contract, and signals get mixed. That’s the art of it. But this framework gives you a map when things feel directionless.

Spotting the Shifts: Your Transition Toolkit

Okay, so how do you know when a transition is happening? You can’t just wait for the official GDP report—that’s like looking in the rearview mirror. You need some forward-looking gauges.

Key Indicators to Watch

- The Yield Curve: Honestly, it’s a classic for a reason. When short-term rates flirt with or exceed long-term rates (an inversion), it’s a powerful, if early, warning of late-cycle pressures and potential recession risk.

- Central Bank Tone: Are they “accommodative” or “hawkish”? The shift from one to the other is a massive clue. When rate hikes start, the clock often starts ticking on the late-cycle party.

- Commodity Prices: A sustained surge in oil, copper, or other industrial materials? That often signals strong global demand (mid-cycle) or inflationary bottlenecks (late-cycle).

- Consumer & Business Sentiment: These are the mood rings of the economy. A sharp drop in business confidence or consumer expectations can precede a pullback in spending and investment.

You know, the trick isn’t picking one indicator. It’s watching for a cluster of them to change direction. That’s your signal that the economic seasons might be turning.

Putting Rotation Into Practice (Without Losing Your Mind)

Here’s the deal: implementing a sector rotation strategy doesn’t mean wildly trading every week. It’s about gradual, thoughtful tilts. Here are a few ways to approach it.

1. The ETF Pivot

The most straightforward method for most investors. Instead of picking individual stocks, you adjust your holdings in sector-specific ETFs. Feeling the late-cycle vibes? Maybe you incrementally increase your exposure to a Energy Select Sector ETF (XLE) or a Consumer Staples ETF (XLP), while trimming a bit from that high-flying tech fund.

2. The “Barbell” Approach for Uncertainty

During transitions—especially into late cycle or recession—the picture is murky. A smart tactic is to use a barbell: you weight your portfolio on both ends of the risk spectrum.

For instance, you might hold both defensive stocks (utilities, healthcare) and secular growth stocks (tech companies with strong balance sheets and independent demand). This way, you’re hedged. If the recession hits, defensives hold up. If the transition drags and growth surprises, you still participate.

3. Mind the “Early Cycle” Snapback

This is a critical, often emotional, point. The early cycle phase, right as recession ends, typically sees the strongest market rallies. And they’re usually led by the very sectors that were beaten down: cyclicals, financials, discretionary. The hardest thing is to buy into that uncertainty when fear is still high. Having a plan to rotate into these areas when others are fleeing is where real alpha is often made.

The Human Hurdles: Psychology of Rotation

Strategies look great on paper. The real friction is in our own heads. Sector rotation forces you to sell what’s been working (and feels good) to buy what’s been lagging (and feels risky). It’s contrarian by nature.

- Chasing Performance: The biggest mistake? Rotating after a sector has already had its big run. You’re buying high, not early.

- Over-rotating: Making huge, all-in bets on one phase. This isn’t gambling. It’s about adjusting your sails, not jumping ship.

- Ignoring Valuation: Even the “right” sector can be a bad investment if you pay a ridiculous price for it. Always layer in valuation checks.

In fact, a little humility goes a long way. It’s okay to get the transition timing slightly wrong. The goal is to be roughly right, not perfectly precise—which is impossible anyway.

A Final Thought: Rotation in a Disrupted World

Today’s economic transitions feel… different. We have geopolitical fractures, AI disruption, and rewired supply chains all playing out in real-time. The old cycle model is a guide, not a gospel.

Maybe some sectors, like technology, now have such embedded secular growth that they defy pure cyclical logic. Perhaps the clean energy transition creates a whole new sub-cycle within industrials and materials. The point is to use the framework, but not be a prisoner to it. Stay flexible. Listen to the new data.

At its core, sector rotation during economic transitions is about respectful awareness. It’s acknowledging that economies breathe in and out, and different industries take their turn leading that breath. By tuning into that rhythm, you’re not just reacting to the market—you’re positioning for its next, inevitable, beat.